Cliff for EastCham Finland: new markets in Central Asia

Within the meaning of the Federal Law of 26.10.2002 No. 127 FZ "On Insolvency (Bankruptcy)" (hereinafter — Bankruptcy Law) depending on the procedure used in the case, the objectives of the institution of insolvency (bankruptcy) of the debtor — legal entity are:

- in observation

- ensuring the safety of the debtor's property,

- analysis of the financial condition of the debtor,

- holding the first meeting of creditors,

- drawing up a register of creditors' claims;

- within the framework of financial recovery and external management

- restoring the solvency of the debtor;

- in the procedure for concluding a settlement agreement

- termination of bankruptcy proceedings by reaching an agreement between the debtor and creditors;

- in bankruptcy proceedings

- proportionate satisfaction of creditors' claims.

Within the meaning of the Federal Law of 26.10.2002 No. 127 FZ "On Insolvency (Bankruptcy)" (hereinafter — Bankruptcy Law) depending on the procedure used in the case, the objectives of the institution of insolvency (bankruptcy) of the debtor — legal entity are:

At the same time, there may be no economic and other problems leading to the bankruptcy of the organization; accordingly, the company will not have objective reasons for initiating its own bankruptcy proceedings.

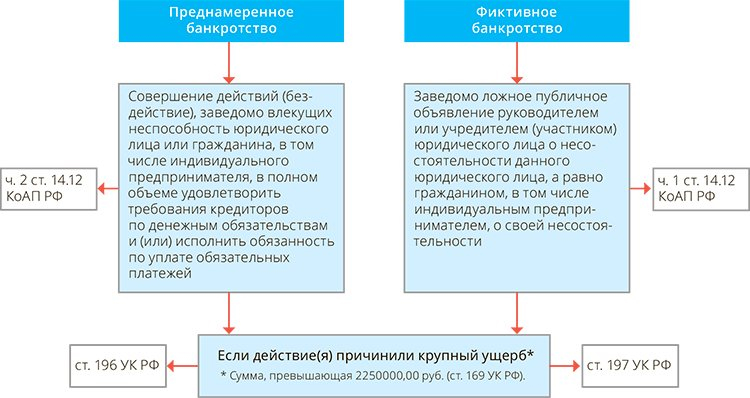

Meanwhile, company executives often use the legal mechanisms provided by the Bankruptcy Law to the detriment of the interests of their creditors, participants and shareholders. Such actions of the top management of the debtor company may constitute an offense or crime called "deliberate bankruptcy"; and "fictitious bankruptcy".

A more detailed description of the signs of intentional and fictitious bankruptcy, as well as specific actions that result in the company's inability to meet the requirements of creditors and (or) misleading the debtor's creditors, are contained in the Methodological Recommendations for the Detection and Prevention of Crimes in the Sphere of the Economy and Against the Management Order, committed by the parties of enforcement proceedings (hereinafter - Methodological recommendations), approved by the Federal Bailiff Service of Russia on April 15, 2013 No. 04-4, and the Provisional Rules for checking by the arbitration manager the presence of signs of fictitious and deliberate bankruptcy (hereinafter - Provisional Rules), approved by the Decree of the Government of the Russian Federation dated 27.12.2004 № 855.

Let us remind you that only the liquidation of a company is a way of completely terminating activities, without entailing any legal consequences. Consider in the article the main issues that owners face:

- who is the liquidator of the company

- liquidation deadlines

- Inventory of assets and preparation of a preliminary list of creditors

- Is it necessary to submit reports in the process of liquidation

- when and how to fire employees.

- is it possible to liquidate a company with debts

Many mistakenly believe that the procedure for exclusion of a legal entity from the Unified State Register of Legal Entities, provided for by law and actively applied in practice, is a simple and convenient alternative to liquidation. Let's get to the bottom of it.

PROCEDURE FOR EXCLUSION FROM THE USRLE

At first glance, the procedure for exclusion from the Unified State Register of Legal Entities can be used by participants in civil transactions as an alternative to liquidating a company.

This is an extrajudicial (administrative) special procedure for terminating activities, not related to the liquidation of a company in the full understanding of the legal consequences of official liquidation. Many believe that this is the same liquidation. This is wrong. Exclusion from the Unified State Register of Legal Entities — this is not liquidation, but a fixed fact, equated to a unilateral refusal to fulfill the obligation of an absent debtor

This tool was invented by the legislator for only one purpose — cleaning the registry from abandoned firms. The basis for exclusion of the company from the Unified State Register of Legal Entities previously consisted in the simultaneous presence of two signs: the company has not submitted tax returns for the last 12 months and has not carried out transactions on at least one of its accounts. Recently, the registrar has been actively applying the grounds for exclusion from the registry — the presence of unreliable information in the Unified State Register of Legal Entities and the expiration of six months after making an entry about this unreliability.